After two years of sharp declines, the 5G network equipment market appears to have reached its lowest point. Market research firm Dell’Oro reported a sales decline of 10% to 20% in the first nine months of 2024 but now anticipates either stabilization or a modest 2% growth in 2025. Last week, Ericsson revealed a 4% year-over-year revenue increase in its mobile networks division for Q4 2024, following a 12% decline in the first three quarters. Meanwhile, Nokia, which saw a 28% drop during the same period – largely due to losing its contract with AT&T – experienced only a 1% dip in Q4.

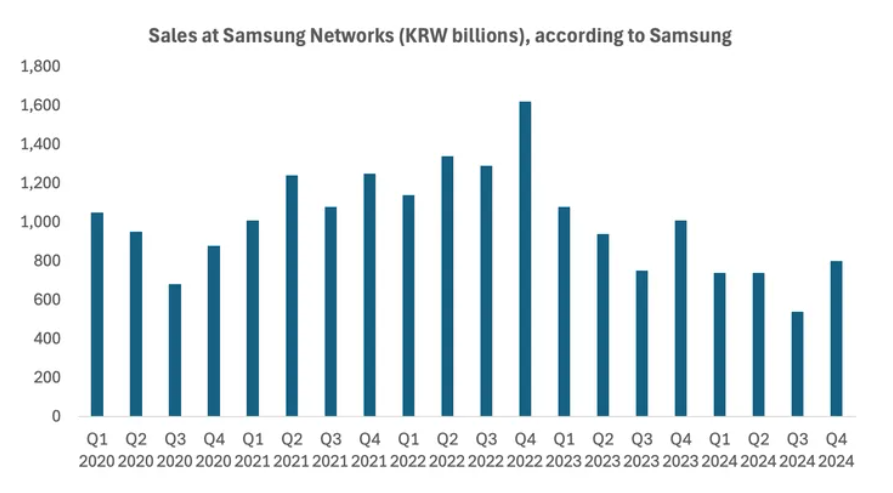

However, Samsung, which has positioned itself as an alternative to Chinese vendors in markets with restrictions, has not seen similar signs of stabilization. The company’s networks division reported a 27% revenue decline in the first nine months of 2024, amounting to approximately KRW 2 trillion ($1.4 billion), as demand for 5G infrastructure weakened. Its latest earnings report indicates a 20% revenue drop in Q4, bringing sales down to KRW 800 billion ($550 million).

Although this suggests some recovery, Samsung’s full-year sales fell by 25% – a steeper drop compared to Nokia’s 21% and Ericsson’s 8%. Notably, Ericsson benefited from taking over Nokia’s lost AT&T contract. Samsung’s network equipment profitability remains unclear, as the company reports this segment alongside its significantly larger consumer electronics division. While Samsung provides a separate revenue breakdown for consumer devices, operating profit is reported jointly for both segments. Despite a 4% rise in total sales to KRW 25 trillion ($17.2 billion), combined profits for the two divisions fell by 22% to KRW 2.1 trillion ($1.5 billion).

Setbacks in India and the U.S.

Samsung has faced difficulties in the 5G market, particularly in India, where network expansion slowed considerably in 2024 after a surge the previous year. Ericsson and Nokia both cited this slowdown as a factor in their weak performance, but Samsung was hit even harder. Previously, it held an exclusive contract for Reliance Jio’s entire 4G radio access network (RAN), making Jio the country’s largest telecom provider. However, for 5G deployment, Jio opted to partner with Ericsson and Nokia instead, significantly impacting Samsung’s market share. As a result, its annual network revenues have nearly halved since peaking in 2022.

In the U.S., Verizon, a major Samsung client, previously chose the company to replace Nokia during a period when the Finnish vendor faced product challenges. However, the rollout has progressed slower than expected. As of October 2024 – four years after Verizon first partnered with Samsung – Nokia equipment was still in use at around 10,000 Verizon mobile sites, according to industry sources.

Additionally, U.S. telecom operators, including Verizon, have significantly reduced capital expenditures in recent years. Following pandemic-related supply chain concerns, many providers stockpiled equipment, leading to a prolonged period of reduced spending. Verizon’s capital expenditures declined by $4.3 billion in 2023, dropping to approximately $18.8 billion, with a further 9% reduction in 2024 to around $17.1 billion.

Samsung has also struggled to secure contracts with other major U.S. telecom providers. AT&T’s $14 billion agreement with Ericsson poses a significant barrier to any future business opportunities with Samsung. While AT&T has marketed this as an “open RAN” deal – allowing for multiple vendors – it has already selected Fujitsu and Mavenir as additional radio unit suppliers, making further diversification less likely.

Furthermore, AT&T is committed to having a single supplier for service management and orchestration, which, according to Ericsson, solidifies its reliance on the Swedish company for RAN software as well. Given competitive dynamics, partnerships between Tier 1 vendors (such as Ericsson and Samsung, or Ericsson and Nokia) are generally less feasible than those between Ericsson and smaller providers.

Prospects for Growth

Despite these setbacks, there are still potential opportunities for Samsung. T-Mobile remains a viable customer, and Verizon has announced plans to increase capital expenditures in 2025, budgeting $18 billion – up from the previous year. A notable development for Samsung is the appointment of Yago Tenorio as Verizon’s chief technology officer. Tenorio, a strong proponent of virtual and open RAN (vRAN/ORAN), previously led Vodafone’s network strategy and has been a vocal supporter of Samsung. When Vodafone replaced Huawei in the UK, Samsung was selected as the primary supplier for RAN software and most radio units.

The industry is now closely watching Vodafone’s upcoming procurement process, which covers tens of thousands of sites across Europe and Africa. Given Samsung’s established role in Vodafone’s UK and Romanian networks, it is well-positioned to secure a significant share of these contracts. Additionally, in European markets where governments mandate the removal of Huawei equipment, Samsung has a clear opportunity to expand.

For now, Samsung’s official guidance for the current quarter indicates an expected sales decline due to reduced spending by domestic telecom operators. However, the company anticipates improved performance throughout the year, citing “network expansion by major operators, securing new business orders, and increased adoption of vRAN/ORAN” as key drivers.

Samsung’s financial strength, backed by a parent company that invested approximately $24 billion in R&D last year, offers reassurance to telecom operators wary of smaller vendors’ long-term viability. Nevertheless, with Dell’Oro forecasting zero RAN market growth over the next five years, Samsung’s gains may ultimately come at the expense of its competitors.